Metalplate Galvanizing asks Jeff Davis School Board for tax exemption

Published 4:36 pm Thursday, October 21, 2021

- Metalplate Galvanizing provides hot-dip galvanizing products to steel, petrochemical and other industries to protect metal from corrosion. (Special to the American Press)

JENNINGS — The Jeff Davis Parish School Board is considering a tax break for a $885,670 plant expansion for a local metal galvanizing facility, located just west of Jennings.

Metalplate Galvanizing, Inc. is seeking an industrial tax exemption to help offset the cost of the expansion in Jeff Davis Parish.

The exemption is part of the state’s Industrial Tax Exemption Program (ITEP), which makes tax incentives available for manufacturers who commit to jobs and payroll.

During a finance committee meeting Tuesday, Finance Committee Chairman Jimmy Segura said the total annual exemption being requested for all applicable taxing jurisdictions, including the School Board’s share, is about $41,541 per the Jeff Davis Parish Assessor. The exemption must also be approved by the Jeff Davis Parish Police Jury and Sheriff’s Office.

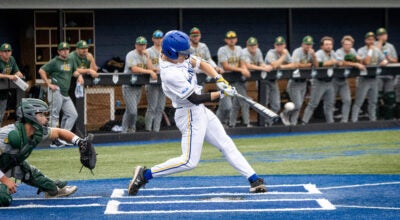

Metalplate Galvanizing, Inc. built a 50,000-square-foot, $9.75 million facility, off Farm Supply Road and U.S., in 2015. It provides hot-dip galvanizing products to steel, petrochemical and other industries to protect metal from corrosion.

Superintendent Kirk Credeur said the company wants to expand its existing manufacturing facility to create 28 jobs with a payroll increase of over $2 million.

“Several things that we are generally looking for in making our decision is, is the project going to generate some local economy, is it going to provide locally high paying jobs, is it going to be something that exist over a period of time and is it going to be beneficial for the district,” Credeur said. “The trade-off would be if you are going to do something beneficial and invest your time and money into our school district, provide jobs and an economic boost, then each local entity could choose whether or not they would exempt that portion of the tax.”

The board did not take action on the tax exemption request pending a Zoom call on Friday in which more information will be provided by the company, Credeur said.

In a related matter, the board discussed a non-compliance issue with Louisiana Spirits in Lacassine for failing to met the requirements of their original (tax) exemption allocation in 2020. The application required the company to maintain three jobs and a payroll of $90,000, which it failed to do, according to Credeur.

The School Board can either defer any decision or action on the matter to the Louisiana Board of Commerce and Industry or make a recommendation to the board on the consequence for non-compliance.

Louisiana Spirits, which opened in 2013, produces Bayou Rum and operates an event center at its facility in Lacassine.

The School Board denied the original request in 2019, but due to discrepancies in the timeframe, the company was able to appeal the decision and won.

Credeur said the School Board did not inform Louisiana Spirits of its denial in writing within the 30-days required by the state.

Credeur said the board denied the exemption because the project – construction of an event center – had already been completed and it did not provide the proper number of high paying jobs the company had promised. In addition, he said Louisiana Spirits did not contact the School Board or follow procedure including attending a School Board meeting when the matter was on the agenda.

“They are now asking for another exemption and they did not fulfill the original one, including the three jobs (each) at $30,000 ”Credeur said. “However, we will listen to the information that they provide us this Friday with the Zoom call and I will bring back all the pros, cons and information to the board and the board will make the final decision on whether or not we give this approval.”