Several new state laws to enhance protections for insurance customers

Published 4:16 pm Wednesday, July 6, 2022

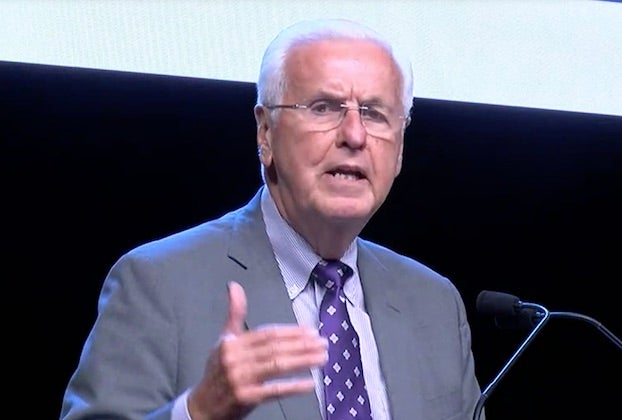

- Louisiana Insurance Commissioner Jim Donelon speaks during the American Press Insurance Claim Town Hall on July 29, 2021, at Eastwood United Pentecostal Church. (Rick Hickman / American Press)

By Ranna Hebert

The Louisiana Legislature passed several laws during its recent session to enhance protections for insurance customers, according to state Insurance Commissioner Jim Donelon.

Donelon, who was joined this week by Senate Insurance Committee Chairman Kirk Talbot of Iberia Parish and House Committee Chairman Mike Huval of Jefferson Parish to discuss the Catastrophe Reform Package, said his office is well aware of the painful challenges still facing homeowners.

Donelon said his office has fielded about “7,000 complaints as a result of the damage and devastation” caused by Hurricanes Laura, Delta, Zeta and Ida.

Not only were there hundreds of thousands of claims filed against insurers because of significant storm damage, but the multiple hurricanes directly led to insurer insolvencies, Donelon said. To address the various bankruptcies, Donelon said legislation sponsored by Sen. Joseph Bouie, D-New Orleans, increases the minimum capital and surplus requirements for insurers licensed to write certain insurance policies.

“Frankly, we copied that legislation from what Florida had done three or four years ago, raising their capital and surplus requirement for a license to do property insurance in that state from $2-$3 million to $10 million,” Donelon said.

For existing companies, there is now a five-year phase-in to get to the $5 million level in a 10-year phase-in period to get to the total of $10 million. Donelon said all existing companies operating in Louisiana have already met the $5 million threshold.

Act 434 replaces the requirement for an emergency declaration with consideration of the totality of circumstances, to ensure coverage in those unique circumstances.

Donelon said various parishes were ordered to evacuate storms, while some were ordered to get out of harm’s way but did not mandate residents to leave. Allstate voluntarily said they would waive the requirement of an evacuation order and pay those evacuation expenses subject to other provisions in the policy.

“Unlike Allstate, there was a dispute with State Farm, who refused to follow a directive I issued to pay those evacuation expenses in the parishes that were declared an emergency by the governor. Therefore, Rep. Laurie Schlegel of Metairie filed a bill that removes the requirement that mandates that in addition to any requirements such as a policy that called for a mandatory evacuation or an evacuation order of any sort be triggered before coverage would kick in for those expenses is now replaced by the totality of the circumstances surrounding the approach of that hurricane conditioned on, limited to, only those parishes declared an emergency by the governor but those coverages must now be triggered with or without regard to the issuance of a local official of a mandatory or any form of an evacuation order at all,” Donelon said.

Kirk Talbot said the main thing legislators wanted to do was “make sure that the insurance market is working better for policyholders as we move forward and also, we wanted to attract insurance companies to come to Louisiana.”

He said lawmakers approved Senate Bill 412, now Act 754, to create an Insurance Incentive Program to provide financial incentives to attract more insurance companies to do business in the state and in turn create a more competitive market.

Talbot also discussed SB 198, now Act 263, to establish a three adjuster rule, which would require insurance companies to provide an update on claims, as well as a primary contact person, after a third adjuster is assigned during a catastrophe.

“The Three Adjuster Bill is simple; essentially, if an individual is on their third adjuster in six months, the insurance companies are required to give the individual a single person that is going to be their point of contact- someone that knows the claim, knows the process, and provides written status reports of the claim,” Talbot said.

Talbot’s SB 163, now Act 80, would require specific disclosures for the catastrophic claims process that include an explanation of the claims process and how the insurer will communicate, explanation of the supplemental claim process, an explanation of the methodology used in calculations, an explanation of actual cash valuation versus replacement cost valuation, items necessary to document a claim, how to complain to the insurance department, and other details of the process.

This act, according to Talbot, “deals with the catastrophic claims process disclosure form which consolidated your explanation of benefits; it explained the whole process on what you’re going to go through, what to expect when you have to make a claim, and more importantly, it talks about the supplemental claim process along with the procedure to file a complaint with insurance companies.”

Huval highlighted HB 521, now Act 157, to require residential and auto insurance companies to file a catastrophic response plan with the Department of Insurance. The plans must include items like emergency contact, alternative work sites, and processes for claims processing that are subject to the approval of state officials.

“In the review of these plans, the Department of Insurance will have the ability to determine whether the insurance catastrophe response plans are acceptable,” Huval said. “The Commission of Insurance has the authority to take regulatory action against any entity that violates the law.”

Therefore, the new law will ensure Louisiana insurance companies are ready and prepped for a massive influx of claims that come after significant hurricanes.

Huval also sponsored HB 612, now Act 554, to create the Louisiana Fortify Homes Program under the Department of Insurance that allows homeowners to apply for grants to retrofit roofing to higher standards. The grants do not cover permits and come with some eligibility requirements, he said.

To be eligible, homeowners must meet a variety of eligibility requirements and will be expected to pay permits, inspections, and similar fees. In addition, the grants will cover the additional cost of retrofitting homes to the fortified room standards in most cases, Huval said.