Hurricane season prep: Donelon gives 4-point plan for insurance

Published 7:52 am Friday, June 2, 2023

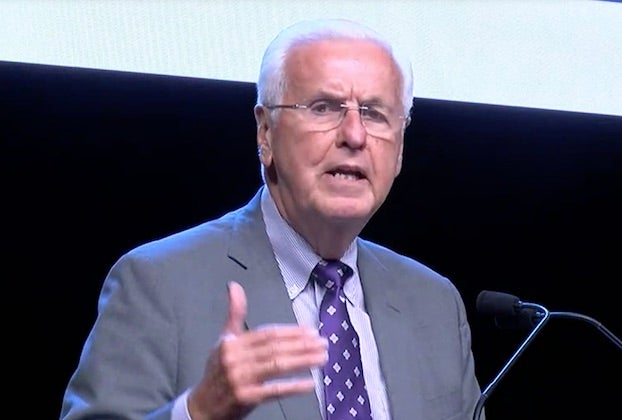

- Louisiana Insurance Commissioner Jim Donelon speaks during the American Press Insurance Claim Town Hall on July 29, 2021, at Eastwood United Pentecostal Church. (Rick Hickman / American Press)

At the start of every hurricane season, The National Oceanic and Atmospheric Administration makes its forecast and Louisiana Insurance Commissioner Jim Donelon makes his media tour to remind residents to “have homeowner’s insurance coverage in place, know what’s covered and more importantly, know what’s not.”

This hurricane season will be average, according to the NOAA, 12 to 17 named storms, one to four are projected to be major, five to nine could be hurricanes.

This hurricane season marks Donelon’s last as Insurance Commissioner, an office he’s held since 2006. In Thursday’s meeting with the American Press, he offered his usual four-point plan for insurance preparedness and details regarding a “new wrinkle” in roofing coverage, just one of a few items policyholders should understand ahead of a storm.

He also gave an update on the incentive program designed to attract new companies to provide coverage, which could provide much-needed relief for Louisiana Citizen policyholders dealing with a 63 percent rate increase.

One. Donelon’’s first piece of advice is, Get flood insurance. “As controversial and expensive as it’s become, it is still significantly subsidized by the federal government,” he said. The difference between flood insurance payouts to insurance policy holders and FEMA grants approved for the uninsured is significant, $90,000 per average payment for insured losses compared to $9,500 for uninsured losses.

Two. The homeowner should understand the policy’s language, numbers and percentages, especially when it comes to deductibles and coverage. Calling the company could clear up any confusion.

“One-third of insurance policies now have a five percent hurricane or named storm deduction,” Donelon said. “That is not five percent of your damage. It’s five percent of your insured value. If the home is valued at $200,000, five percent is $10,000. If the roof is blown off, a tree falls through it or a storm blows enough shingles off and it’s time for a new roof, the policyholder will have to come up with $10,000, for a $15,000 roof. Policy holders need to know that or at least be prepared for how they’ll get that $10,000.”

The age of the roof could matter more than the homeowner realizes. This is a “new wrinkle,” Donelon said. Some companies aren’t writing policies for roofs ten or even five years old. However, other companies are writing policies no matter the age of the roof and will cover the replacement value, which has been the tradition, Donelon said. Still, homeowners need to be aware that some companies will write the homeowner a policy but only give the value of the roof after depreciation. For instance if the life expectancy of the roof is 20 years and it’s ten years old, the homeowner will receive the depreciated value or around 50 percent of the replacement cost.

Not every insurance company handles evacuation expense reimbursement in the same manner. Generally speaking, evacuation has to be mandated for expenses to be covered. Because Hurricane Ida came in slow at a category three, some officials did not mandate evacuation, leaving certain policy holders who did evacuate unable to receive reimbursement for those expenses.

Three. File as quickly as possible. Homeowners who choose to evacuate should get in touch with their provider to determine if evacuation expenses are covered, and they should take their policy with them when they evacuate. “You can call your company from your hotel room and get in line sooner rather than later. The sooner you do, the sooner you can get an adjuster and local, reputable contractor,” Donelon advised.

Four. Walk through the home and take photos of contents, furnishings, appliances, electronics, art, tools in the garage. “Folks tend to forget things without a list or picture,” he noted.

Three-year rule and additional incentive funding

With the help of the Governor John Bel Edwards, Donelon said he was recently able to defend the “three-year rule”, the most important consumer protection insurance law put forth as a bill by Jim Cox and passed in 1992.

“Cox was a former Senator, and still lives in Lake Charles,” Donelon explained. The bill basically says “if you’ve been with your insurer three or more years, you’re married. They can’t not renew you, change your premium or deductible without doing it to their entire statewide book of business.”

Final passage of a $45 million funding bill for incentivising insurance companies to do business here has cleared the Senate and is now back in the house for concurrence, Donelon said.

These incentivised companies, ideally, will help depopulate Citizens, the most expensive coverage available for purchase (similar to higher premiums paid by drivers who have more accidents and violations).