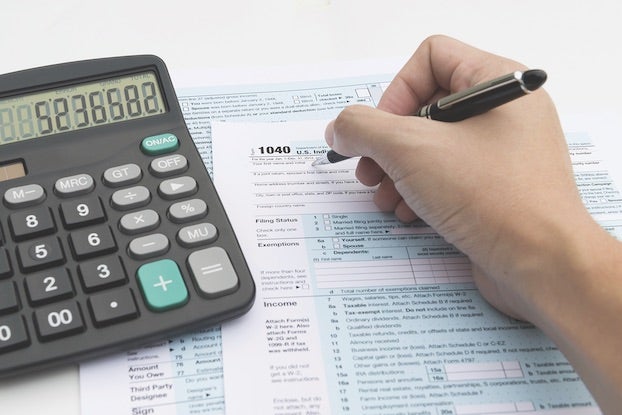

It’s tax time: What to know before you file

Published 2:57 pm Tuesday, January 25, 2022

- (Metro Creative Services)

File federal income taxes as soon as now through April 18 this year — but don’t get in too big of a hurry.

Wait for letters outlining advance child tax credit and stimulus checks, recommends local CPA Pam Mancuso of McMullen, Mancuso, Trahan & Funk CPAs, who said, “You’ll need those.”

Filing season opens earlier because the IRS is “anticipating an awful filing season,” Mancuso said.

She also advises filing online and getting refunds direct-deposited.

“Direct deposit is highly encouraged because the IRS doesn’t have the personnel to process paper checks in a timely manner,” Mancuso said. “The last report I received, they were 15 months behind in opening mail.”

In December, the agency had 6 million unprocessed individual income tax returns and 2.3 million unprocessed amended individual tax returns, according to a report released by the National Taxpayer Advocate.

Mancuso said only a very small percentage of phone calls are being answered, as low as three percent.

“The status is critical,” she said. “I don’t ever remember it being this bad before.”

Mancuso has been in the accounting industry for more than 30 years.

The IRS began falling behind during spring of last year. Federal offices closed after the stay-at-home mandate March 2020 because of the pandemic.

“Nobody was there to process mail or answer phone calls,” Mancuso said. “When it was OK to go back, not all could go back. Now, some of those employees have retired and no one has taken their place.”

Additional work was created for the department as they were responsible for issuing CARES Act and American Rescue Plan stimulus and child credit checks based on information from 2019 tax returns.

Finding and matching that information was also the job of the IRS.

Individuals who did not report stimulus and other recovery payments typically didn’t see a refund in a timely manner as checks and balances didn’t match up. That’s why it’s important to wait for the letter outlining those payments for 2021 and include that information with this year’s return.