PAR raises concerns about Jindal tax swap plan

Published 1:32 pm Friday, January 18, 2013

BATON ROUGE (AP) — Gov. Bobby Jindal’s plan to get rid of state income taxes in favor of higher sales taxes could weaken the state’s income foundation for providing services to the public, a nonpartisan government watchdog organization says.

“A repeal of the individual income tax could create a more attractive perception of the state’s tax climate, but such a move runs the risk of destabilizing the state’s revenue base and would likely set the stage for increased taxes in the future,” says a report released this week by the Public Affairs Research Council’s tax advisory panel.

The Baton Rouge-based organization also said a shift to a sales tax-focused system could fall more heavily on the poor, retirees and the disabled and could put Louisiana stores at a disadvantage as people shop online and out-of-state to escape higher sales tax rates.

Three former budget advisers to governors serve on the 15-member study group, which also includes others with experience in economics, accounting and business. Its commentary was PAR’s first response to Jindal’s still sketchy proposal to eliminate personal and business income taxes in exchange for higher state sales tax rates and the removal of some tax breaks currently on the books.

The Republican governor hasn’t released details of the combination he would use to make up the loss of nearly $3 billion in lost personal income taxes and corporate franchise and income taxes, and PAR’s analysis noted it will continue to review the ideas as more details emerge.

Jindal’s point person on the tax code rewrite, Revenue Department executive counsel Tim Barfield, said the state’s 468 tax exemptions, credits and exclusions make the tax code too complicated and discouraging to businesses. He said the state sales tax, currently 4 percent, is a more predictable revenue stream than income tax.

“When you look at the data and look at it across 50 states and here in Louisiana, sales tax revenues have been the most stable form of revenue. They’ve had the smallest swings from high to low, they correlate with the economy, and that’s very important to us,” Barfield said Friday.

PAR’s study group raised concerns about the loss of the diversified tax revenue and an overreliance on one primary source of income that would make up the bulk of the state’s general fund, saying the income tax “is an important component of Louisiana’s overall balanced and stable tax structure.”

Barfield disagreed, saying if both types of tax streams are tied to the economy, like income and sales taxes, having two sources of funding doesn’t necessarily lead to more stabilization because they both fluctuate with economic improvements and declines.

He pointed to data that showed more significant dips and vacillations in Louisiana’s income tax revenue, compared to sales tax revenue, during the recession.

“Sales tax just seems to be a more reliable form,” he said.

PAR’s panel also noted an increase in sales taxes won’t just fall harder on low-income families, but also could heavily hit public employee retirees, military retirees and people on disability who don’t pay income taxes but will be forced to pay the higher sales tax rates.

Barfield said the administration is considering ways, like a possible tax rebate, to help shrink some of the increased costs of the sales tax hike for low-income workers, and he said the administration is looking at the impact on other groups that don’t pay income taxes.

But he said the focus for a tax rebate or other way to lessen the impact of a sales tax hike is on the poor.

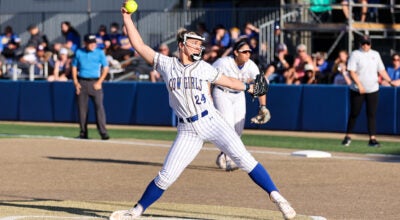

Gov. Bobby Jindal. (American Press)