Local lawmakers discuss Jindal sales tax plan

Published 3:27 am Saturday, January 12, 2013

It’s an interesting idea, but some Southwest Louisiana lawmakers said Friday that they want to see more details on Gov. Bobby Jindal’s proposal to get rid of the state’s personal and corporate income taxes before making a decision on it.

The plan, which Jindal announced Thursday, “will put more money back into the pockets of Louisiana families,” will simplify the state’s tax code, and will attract new businesses. But it would also require some measures to offset the revenue lost by eliminating those taxes. Some of the ones being considered include raising the state’s 4 percent sales tax and raising the tax on cigarettes.

House Speaker Chuck Kleckley, R-Lake Charles, called the plan “very bold and very aggressive,” but said it is a good plan “at the end of the day.” He said he wants to make sure the sales and cigarette taxes are not set too high. Senate President John Alario, R-Westwego, said a “1.6 percent increase in state sales tax” was discussed this week during a meeting with the Jindal administration and legislative leaders, The Advocate reported Thursday.

“At this point in time, it’s still too early to make a judgment on any of this,” Kleckley said. “It’s something that’s still in the works.”

A “sales tax increase is on the table,” said Tim Barfield, executive counsel for the state’s Revenue Department. Other options may include “broadening” the sales tax base and “eliminating some sales tax exemptions,” he said.

Rep. Brett Geymann, R-Moss Bluff, said the proposal has some “interesting components,” but he wants to know how it will work over the long term.

“The big question is, ‘What’s the end game?’ ” he said. “If (the plan) is revenue neutral, why are we doing this major change? Is it going to increase the corporations in our state because they are tax exempt?”

Rep. Mike Danahay, D-Sulphur, said the plan looks good “on the surface,” but he is unsure if raising the sales tax will put more of a strain on low- and middle-class families. Danahay sits on the House Ways and Means Committee, which will review the plan first once the legislative session begins April 8.

“Whenever a family is buying the essentials, it’s an additional burden when you raise the sales tax,” he said.

Sen. Ronnie Johns, R-Lake Charles, said he can’t take sides on the plan until he gets feedback from his constituents and gives his own input.

“It may be something good, and it may put us at a competitive edge for other states that don’t have personal income tax,” he said. “But with us being a border parish, a higher sales tax could have people moving across state lines or cause more Internet sales to purchase retail goods.”

Kleckley said Jindal has committed to meeting with all lawmakers, and that he wants their input on the proposal.

“He’s very open-minded,” Kleckley said.

Geymann said he remains focused on reforming the state’s budget process. He said a draft plan was recently finished and is being reviewed by him and other state lawmakers.

“We’re going to argue the case that we should reform the budget before worrying about tax reform,” he said.

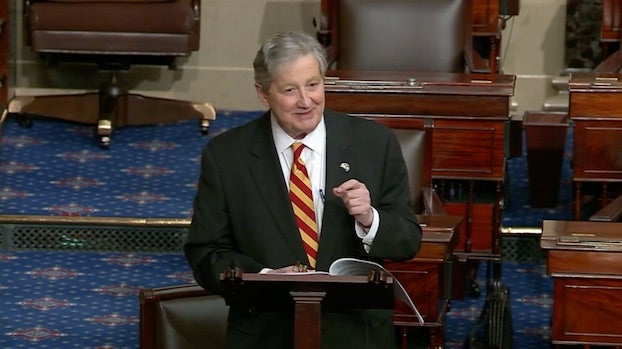

House Speaker Chuck Kleckley