Donelon: ‘La. recovery remarkable’

Published 10:43 am Friday, October 9, 2015

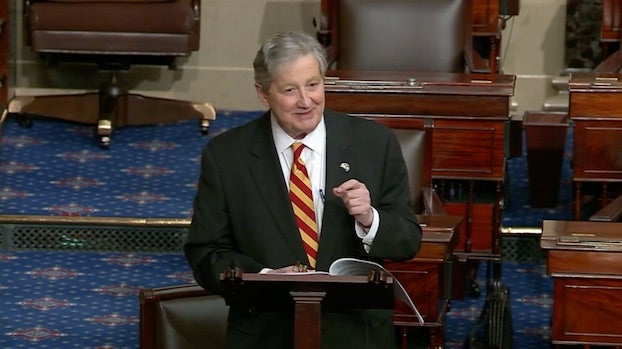

Louisiana Insurance Commissioner Jim Donelon said that despite the “insurance catastrophe” caused by Hurricanes Katrina and Rita 10 years ago, the state is more competitive today than before the storms.

Donelon, a Republican, has served as insurance commissioner since 2006. He was elected to his first full term in 2007 and was re-elected in 2011.

If re-elected Oct. 24, Donelon said this will be his final term.

Donelon told the American Press editorial board Thursday that $25.3 billion was paid out to property owners after Hurricane Katrina, followed by $3.3 billion after Hurricane Rita.

“Needless to say, that devastated our market,” Donelon said. “But we are stronger, viable and more competitive today than we were the day before Katrina hit. Our recovery has been truly remarkable.”

Donelon spoke about a law that requires a property insurance policy to be written for any property owner who cannot get coverage from the private sector. When Katrina made landfall, there were 105,000 policies, he said. That number grew to 173,000 after Hurricane Gustav in 2008. Today, he said that number stands at about 88,000 policies.

Donelon said that Louisiana, more than any other coastal state, did the best job of “filling the vacuum left by the exiting major national carriers.”

“We have 22 new-to-our-state, small regional carriers,” he said.

The cost of auto insurance remains high, with Louisiana being the third highest in the nation. But, Donelon said, the state was ranked highest in the nation when he first took office. Some of the factors that lead to higher rates include bad roads, higher mortality rates with crashes, and increased drinking and driving.

“I think the bigger part of what’s happening nationally and in Louisiana … is texting and driving,” Donelon said. “I think that is causing significant increases in the number of accidents that are happening.”

Donelon said health insurance has become a major challenge since the Affordable Care Act was approved. He said the Louisiana Health Cooperative was created to boost competition in the health insurance marketplace.

He said states were considered noncompetitive if the top two carriers had 70 percent or more of the market share. Blue Cross Blue Shield of Louisiana has 70 percent of the market share in Louisiana, and United Health Care has another 10 percent.

“The Affordable Care Act had a provision for low-interest federal loans to stimulate competition by putting capital funds up to create new health insurance,” Donelon said. “Our co-op got $66 million.”

However, the co-op initiative failed this summer. Donelon said his office is trying to hold Louisiana Health Cooperative together because health care providers could bail out of the plan.

“It has fallen to us to convince the health care providers that they will get paid if they hang with us through the end of the year,” he said.

Donelon said he has reduced the size of his office without losing efficiency. He said his office had 275 full-time workers in 2006, compared with 225 employees today.

“We pay our entire operation out of the fees and licenses that we charge the people we regulate,” Donelon said.

Donelon served as president of the National Association of Insurance Commissioners in 2013. He said Louisiana ranks third in the nation in terms of insurance departments that are open and transparent.

Donelon’s challengers in the October election include Democrats Donald Hodge and Charlotte McDaniel McGehee, along with Matt Parker, a Republican.

(Associated Press)